OBJECTIVES

3.1

Social security in Hong Kong aims to meet the basic and special needs of members of the community who are in need of financial or material assistance.

SERVICE PROVISION

3.2

This objective is achieved through a non-contributory social security system administered by SWD. It comprises the CSSA Scheme, SSA Scheme, Criminal and Law Enforcement Injuries Compensation (CLEIC) Scheme, Traffic Accident Victims Assistance (TAVA) Scheme and Emergency Relief. Elderly CSSA recipients who meet the prescribed criteria can continue to receive cash assistance under the CSSA Scheme if they choose to retire permanently in Guangdong or Fujian Province. In addition, the Social Security Appeal Board, an independent body, handles appeals against SWD's decisions on social security issues.

3.3

Under the CSSA Scheme, the Support for Self-reliance Scheme aims to encourage and assist employable CSSA recipients to take up employment and become self-reliant. The Scheme consists of two components:

- The Integrated Employment Assistance Programme for Self-reliance (IEAPS): provision of one-stop, integrated employment assistance services on family basis by NGOs commissioned by SWD to help employable able-bodied CSSA recipients find jobs.

- Disregarded earnings: provision of an incentive by disregarding part of their income when assessing the amount of assistance payable to CSSA recipients to encourage them to undertake paid employment while on CSSA.

HIGHLIGHTS OF THE PERIOD

OLD AGE LIVING ALLOWANCE (OALA)

3.4

SWD introduced OALA under the SSA Scheme starting from 1 April 2013 as an additional form of financial assistance for needy Hong Kong residents aged 65 or above to supplement their living expenses. To enable eligible elderly people to receive the allowance as early as possible, SWD adopted a set of specially designed simplified procedures in 2013 to process applications for OALA, namely, “Auto-conversion”, “Postal Submission” and “New Application”. In the first year of implementation, a special one-off arrangement was also put in place to effect the payment of OALA from 1 December 2012 retrospectively and extend the grace period to 24 months during which the income and asset of the recipients were assumed to be within the prescribed limits.

GUANGDONG (GD) SCHEME

3.5

SWD launched the GD Scheme under the SSA Scheme with effect from 1 October 2013 to provide OAA to eligible Hong Kong elderly people who choose to reside in GD, without requiring them to return to Hong Kong each year. In the first year of implementing the GD Scheme, a special one-off arrangement was put in place to allow applicants, subject to meeting all other eligibility criteria, who have resided in GD continuously for one year (absence from GD up to a maximum of 56 days during the one-year period is treated as continuous residence in GD) immediately before the date of application to benefit from the Scheme without having to satisfy the one-year continuous residence rule in Hong Kong. For the convenience of elderly persons, SWD set up a designated office in Sheung Shui to handle all applications under the GD Scheme.

INCLUDE POST-SECONDARY STUDENTS OF CSSA FAMILIES IN THE CALCULATION OF RENT ALLOWANCE

3.6

To help relieve the financial burden of CSSA families, SWD included post-secondary student members of CSSA families in the calculation of rent allowance with effect from 1 April 2014, so that the amount of rent allowance of these families will not be affected if they have members receiving post-secondary education.

INCREASE OF THE FLAT-RATE GRANT FOR SELECTED ITEMS OF SCHOOL-RELATED EXPENSES UNDER THE CSSA SCHEME

3.7

To enhance support for CSSA families to meet school-related expenses for their children, starting from the 2014/15 school year, SWD increased the flat-rate grants for selected items of school-related expenses for CSSA students at primary and secondary levels by $1,000 in addition to the annual adjustment.

PROVISION OF RENT ALLOWANCE TO CSSA RECIPIENTS WHO HAVE BEEN TENANTS PURCHASE SCHEME (TPS) FLAT OWNER-OCCUPIERS FOR MORE THAN FIVE YEARS

3.8

The CCF programme of “Subsidy for TPS Flat Owners on CSSA” launched in September 2011 was regularised to provide rent allowance to CSSA recipients who have been TPS flat owner-occupiers for more than five years from the date of first assignment of the flat concerned with effect from 1 April 2014.

PROVISION OF ADDITIONAL ONE-OFF ASSISTANCE TO SOCIAL SECURITY RECIPIENTS

3.9

Having regard to the uncertain external economic outlook and the continued risk of rising inflation, SWD provided one additional month of standard rate of CSSA payment for CSSA recipients and one additional month of allowance for OAA, OALA and Disability Allowance (DA) recipients in July 2013. In August 2014, SWD also provided one additional month of standard rate of CSSA payment for CSSA recipients and one additional month of allowance for OAA (including those payable under the GD Scheme), OALA and DA recipients taking into account the series of recurrent measures introduced by the Government to help the grassroots, the economic outlook for 2014-15 and the financial position in 2013-14.

FRAUD PREVENTION

3.10

SWD continued its efforts to prevent and combat fraud and abuse of social security benefits. To guard against duplicate claims, SWD had been closely cooperating with relevant government departments and organisations in conducting matching exercises.

STATISTICS

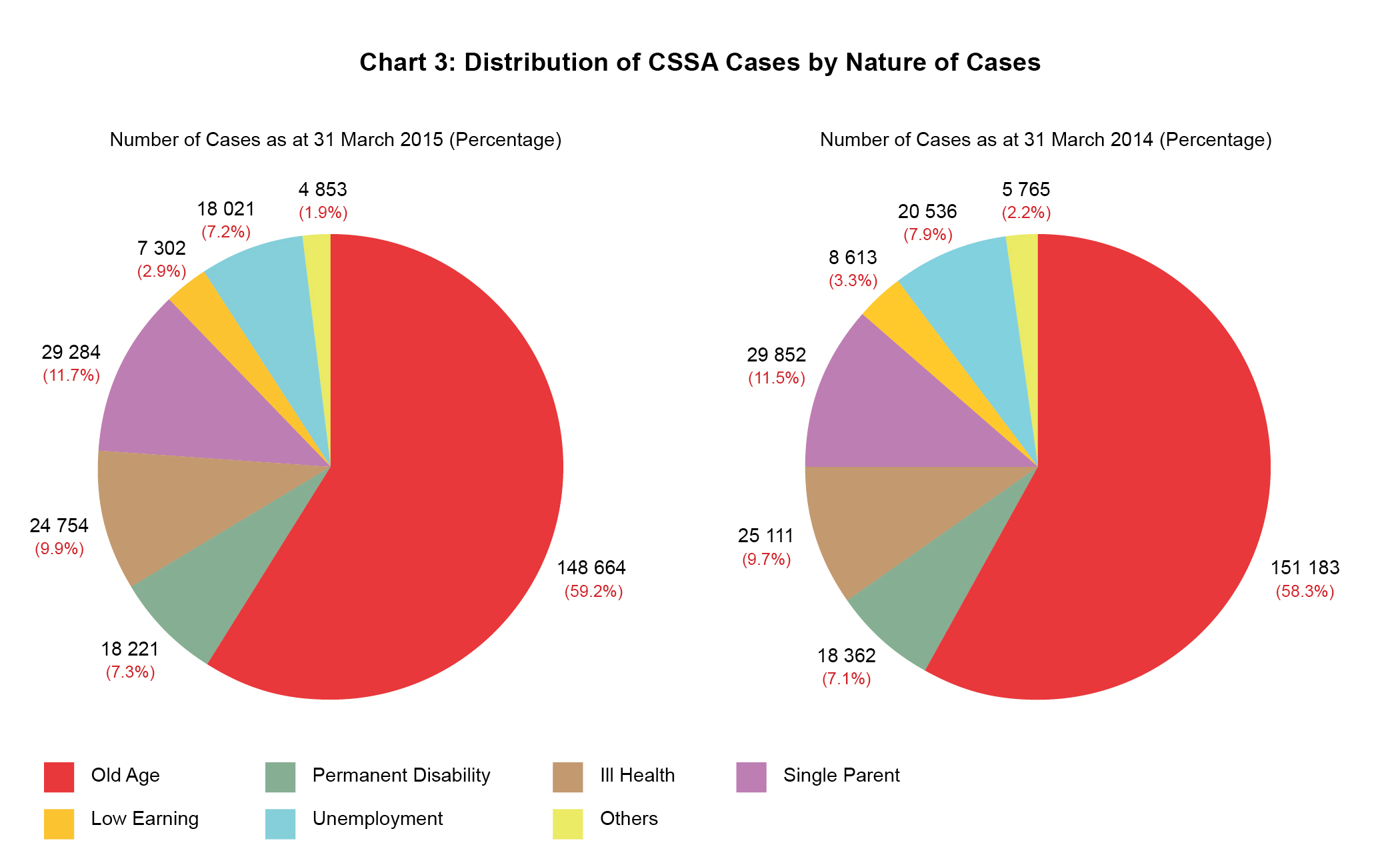

CSSA SCHEME

3.11

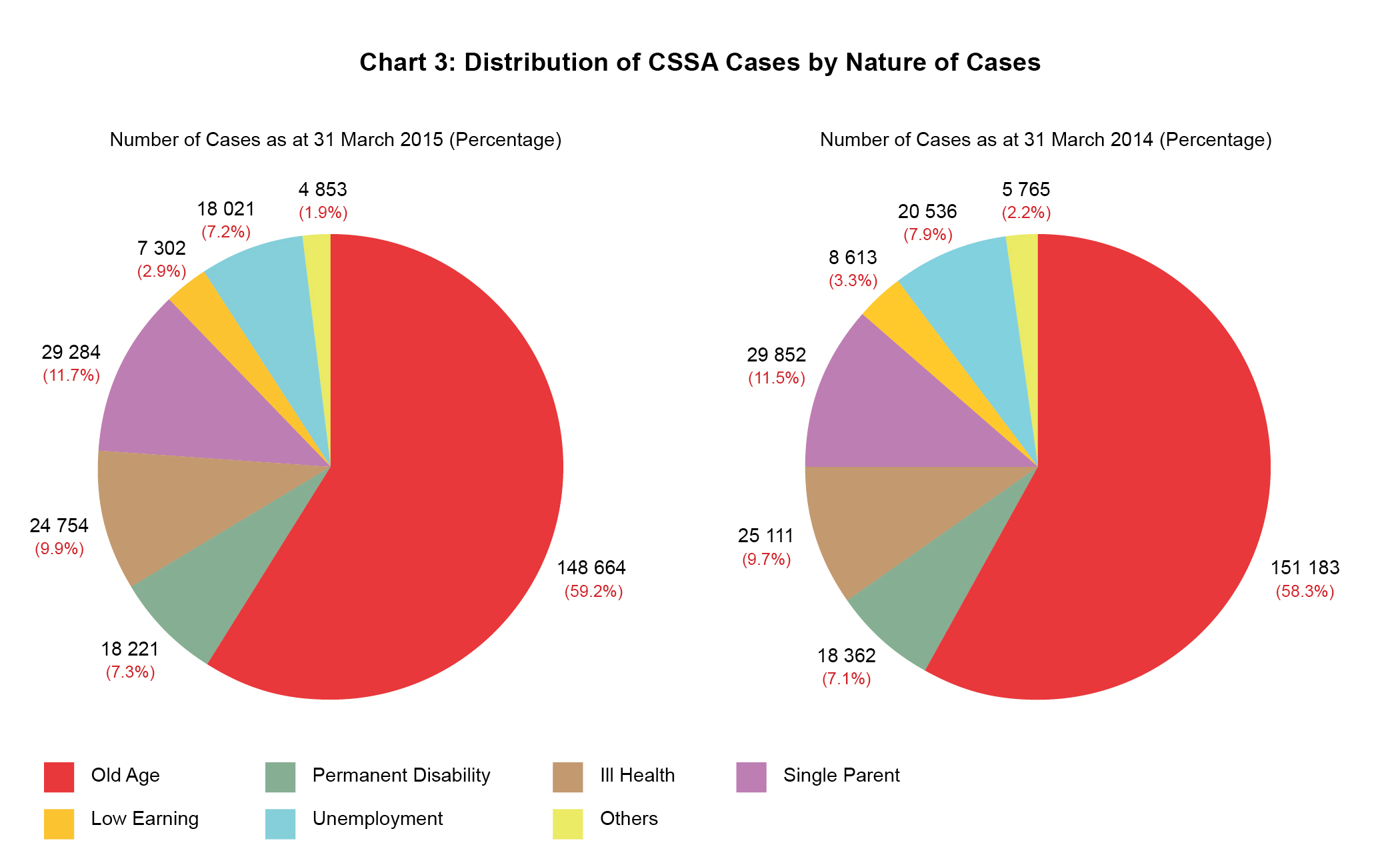

As at 31 March 2014, there were 259 422 CSSA cases providing assistance to 393 353 people. The number of CSSA cases and recipients were 251 099 and 377 460 respectively as at 31 March 2015. The number of CSSA cases decreased in the past two years. Analysis of distribution of CSSA cases by nature of cases as at 31 March 2014 and 31 March 2015 respectively is shown in Chart 3 below:

Note: Individual percentage may not add up to 100% due to rounding effect.

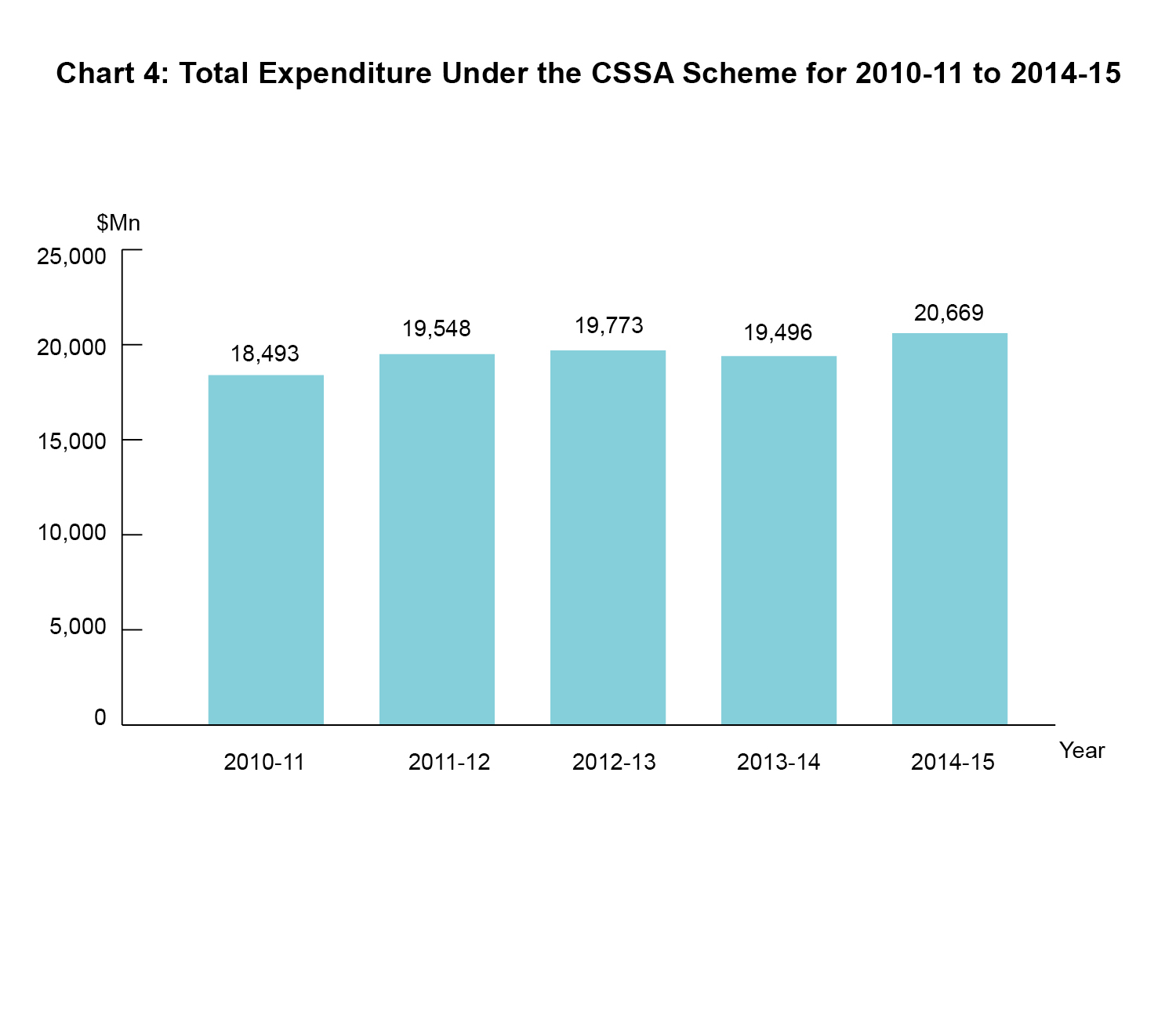

3.12

A total of $20,669 million was paid out under the CSSA Scheme in 2014-15. The total expenditure for the years 2010-11 to 2014-15 is shown in Chart 4 below:

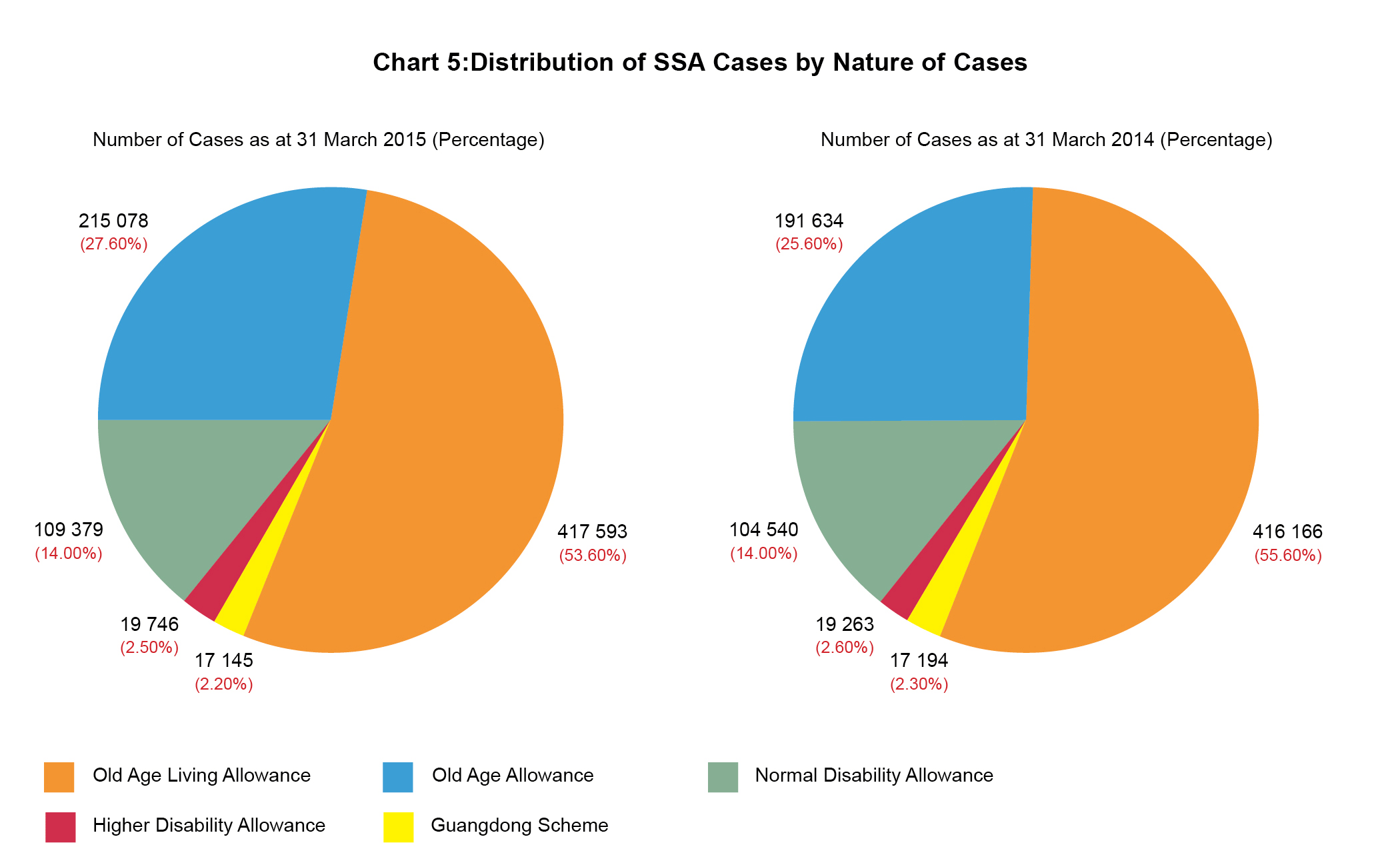

SSA SCHEME

3.13

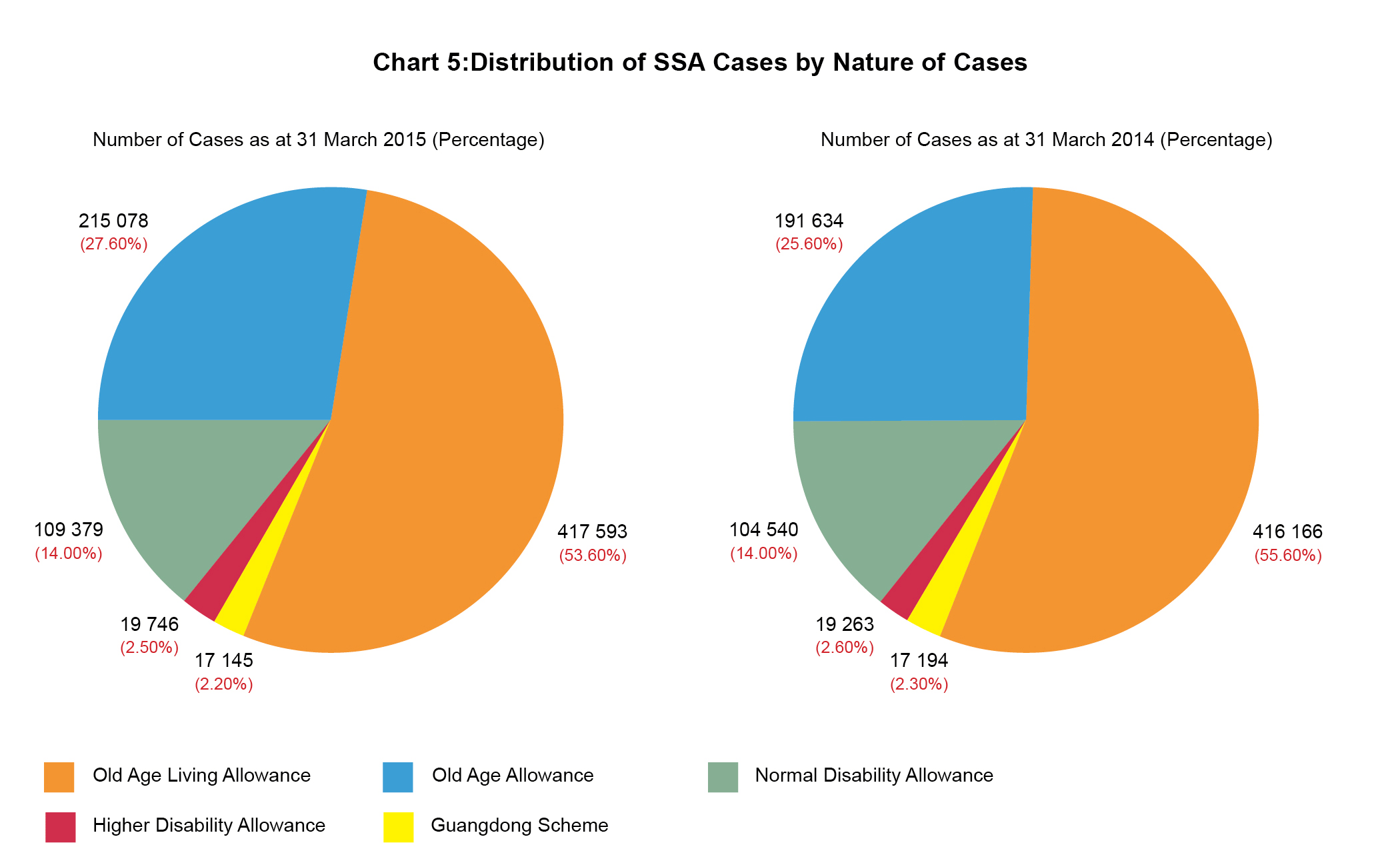

As at 31 March 2014 and 2015, the numbers of SSA cases were 748 797 and 778 941 respectively. A breakdown of these cases by nature of cases is shown in Chart 5 below:

Note: Individual percentage may not add up to 100% due to rounding effect.

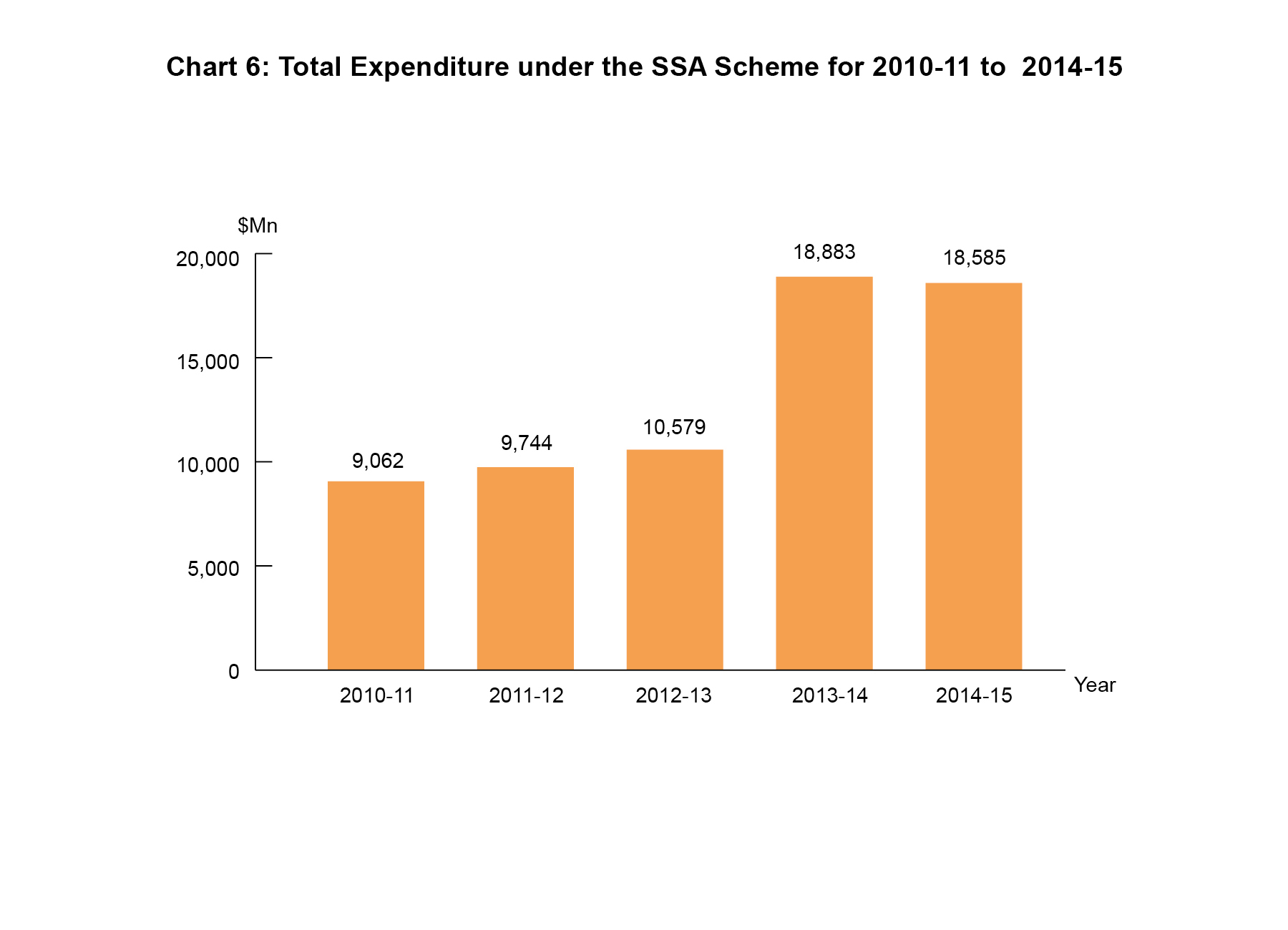

3.14

A total of $18,585 million was paid out under the SSA Scheme in 2014-15. The total expenditure for the years 2010-11 to 2014-15 is shown in Chart 6 below:

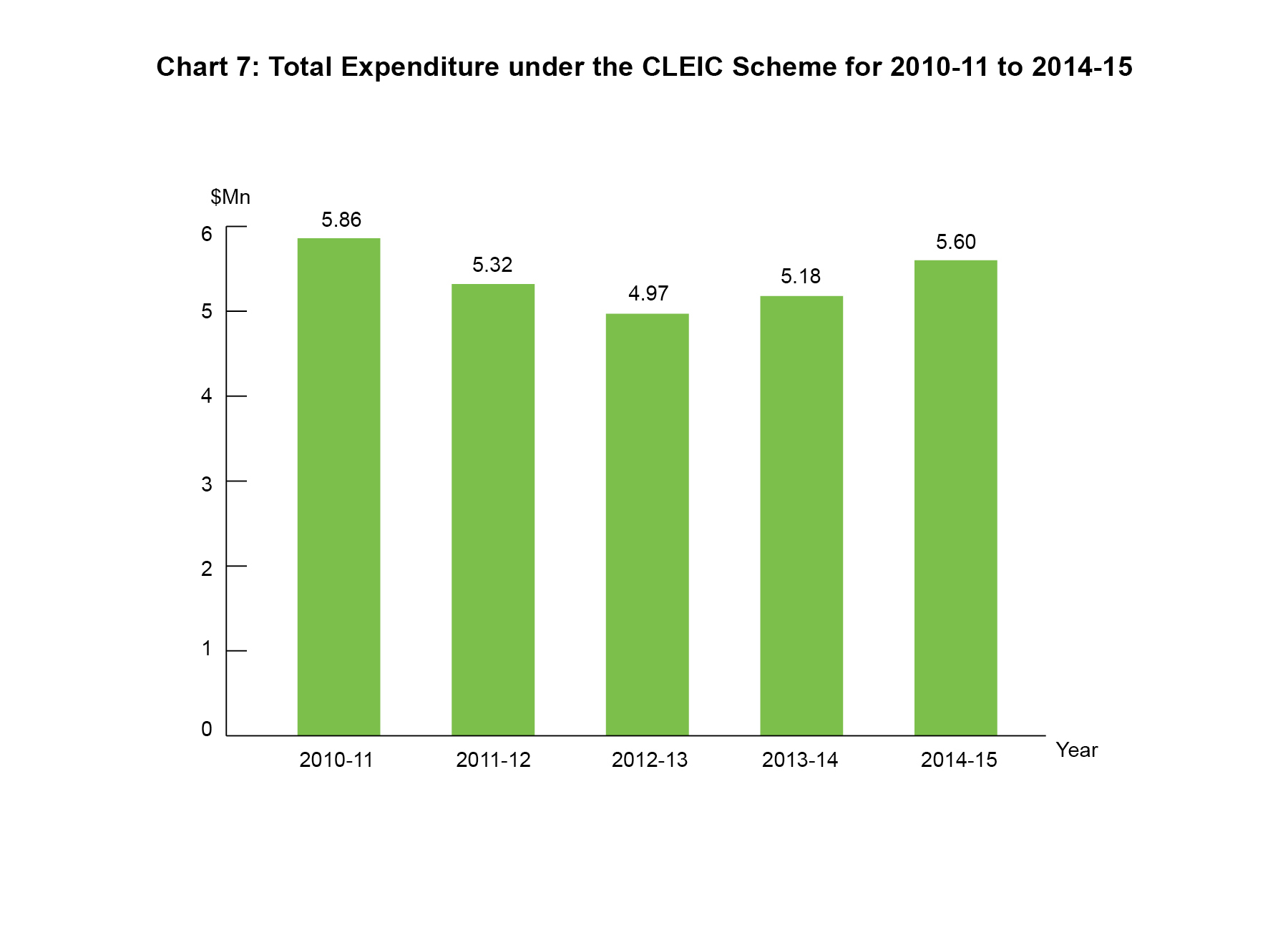

CLEIC SCHEME

3.15

In 2014-15, a total of $5.6 million was paid out under the CLEIC Scheme to 368 cases. The total expenditure for the years 2010-11 to 2014-15 is shown in Chart 7 below:

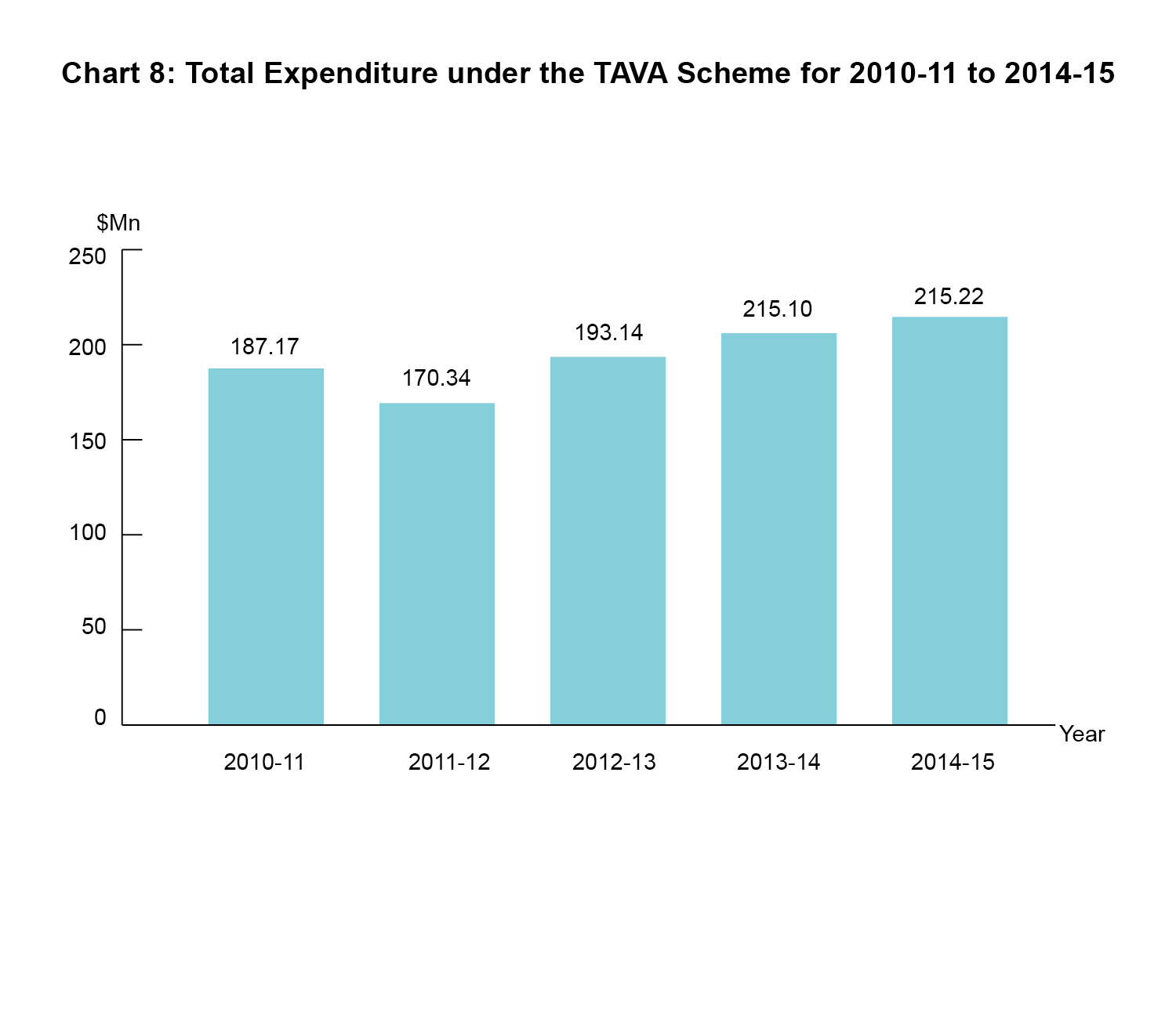

TAVA SCHEME

3.16

In 2014-15, a total of $215.22 million was paid out under the TAVA Scheme to 13 229 cases. The total expenditure for the years 2010-11 to 2014-15 is shown in Chart 8 below:

SOCIAL SECURITY APPEAL BOARD

3.17

The Social Security Appeal Board (SSAB) is an independent body comprising seven non-officials appointed by the Chief Executive. Its main function is to consider appeals against the decisions of SWD under the CSSA, SSA and TAVA Schemes. Decisions of the Board are final.

3.18

In 2014-15, SSAB ruled on 387 appeals, including 95 CSSA cases and 292 SSA cases. The Board confirmed the decisions of SWD in 264 cases (68%) and varied its decisions in 123 cases (32%).