OBJECTIVES

3.1

Social security in Hong Kong aims to meet the basic and special needs of members of the community who are in need of financial or material assistance.

SERVICE PROVISION

3.2

This objective is achieved through a non-contributory social security system administered by the SWD. It comprises the Comprehensive Social Security Assistance (CSSA) Scheme, the Social Security Allowance (SSA) Scheme, the Criminal and Law Enforcement Injuries Compensation (CLEIC) Scheme, the Traffic Accident Victims Assistance (TAVA) Scheme and Emergency Relief. Elderly CSSA recipients who meet the prescribed criteria can continue to receive cash assistance under the CSSA Scheme if they choose to retire permanently in the Guangdong or Fujian Province. In addition, the Social Security Appeal Board, an independent body, handles appeals against SWD's decisions on social security issues.

3.3

Under the CSSA Scheme, the Support for Self-reliance Scheme aims to encourage and assist employable CSSA recipients to take up employment and become self-reliant. The Scheme consists of two components:

- The Integrated Employment Assistance Programme for Self-reliance: provision of one-stop, integrated employment assistance services on family basis by NGOs commissioned by the SWD to help employable able-bodied CSSA recipients find jobs.

- Disregarded earnings: provision of an incentive by disregarding part of their income when assessing the amount of assistance payable to CSSA recipients to encourage them to undertake paid employment while on CSSA.

HIGHLIGHTS OF THE PERIOD

OLD AGE LIVING ALLOWANCE (OALA)

3.4

In addition to continuing the implementation of OALA under the SSA Scheme, we also proactively prepared to enhance OALA through relaxing the asset limits to benefit more elderly persons with financial needs and adding a higher tier of assistance to provide the eligible elderly persons having more financial needs with a higher allowance which is more than about one-third of the existing allowance with an aim to strengthening the support of social security pillar to the elderly persons. Under the enhancement measures, the coverage of OALA will increase ten percentage points substantially to 47%.

PROVISION OF ADDITIONAL ONE-OFF ASSISTANCE TO SOCIAL SECURITY RECIPIENTS

3.5

In view of the challenging international macroeconomic environment, the unstable economic factors, the need to boost the local economy in the short term, and the Government's relatively sound fiscal position in the short to medium term, the Government provided two additional months of standard rate of CSSA payment for CSSA recipients and two additional months of allowance for OAA, OALA and Disability Allowance (DA) recipients in July 2015. In June 2016, one additional month of standard rate of CSSA payment for CSSA recipients and one additional month of allowance for OAA (including those payable under the GD Scheme), OALA and DA recipients was also provided, taking into account the macro environment, the Government's fiscal capacity and the need to boost the economy in the short term.

ABOLISHED THE ARRANGEMENT FOR THE RELATIVES OF ELDERLY PERSONS APPLYING FOR CSSA ON THEIR OWN TO MAKE A DECLARATION ON WHETHER THEY PROVIDE THE ELDERLY PERSONS WITH FINANCIAL SUPPORT

3.6

While maintaining the requirement that applicants under the CSSA Scheme must apply on a household basis, the SWD abolished the arrangement for the relatives concerned to make a declaration on whether they provide the elderly persons who apply for CSSA on their own (e.g. elderly persons who do not live with their children) with financial support starting from 1 February 2017. Singleton elderly persons and families with all members being elderly persons applying for CSSA will not be required to submit written declarations on financial support from family members living apart. Only the elderly applicants will be required to submit information.

FRAUD PREVENTION

3.7

The SWD continued its efforts to prevent and combat fraud and abuse of social security benefits. To guard against duplicate claims, the SWD had been closely cooperating with relevant government departments and organisations in conducting matching exercises.

STATISTICS

CSSA SCHEME

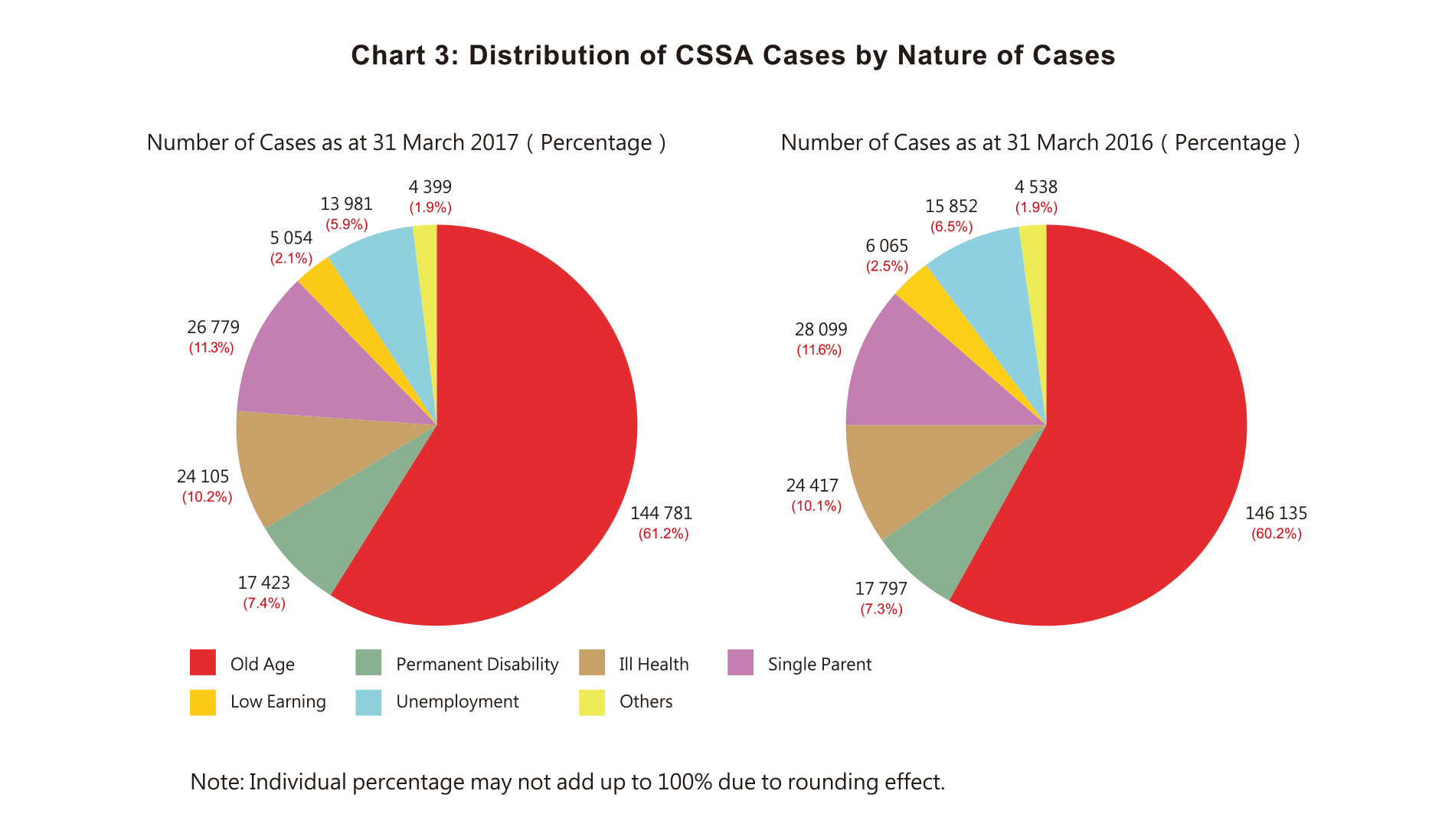

3.8

As at 31 March 2016, there were 242 903 CSSA cases providing assistance to 360 393 people. The number of CSSA cases and recipients were 236 522 and 346 709 respectively as at 31 March 2017. The number of CSSA cases decreased in the past two years. Analysis of distribution of CSSA cases by nature of cases as at 31 March 2016 and 31 March 2017 respectively is shown in Chart 3 below:

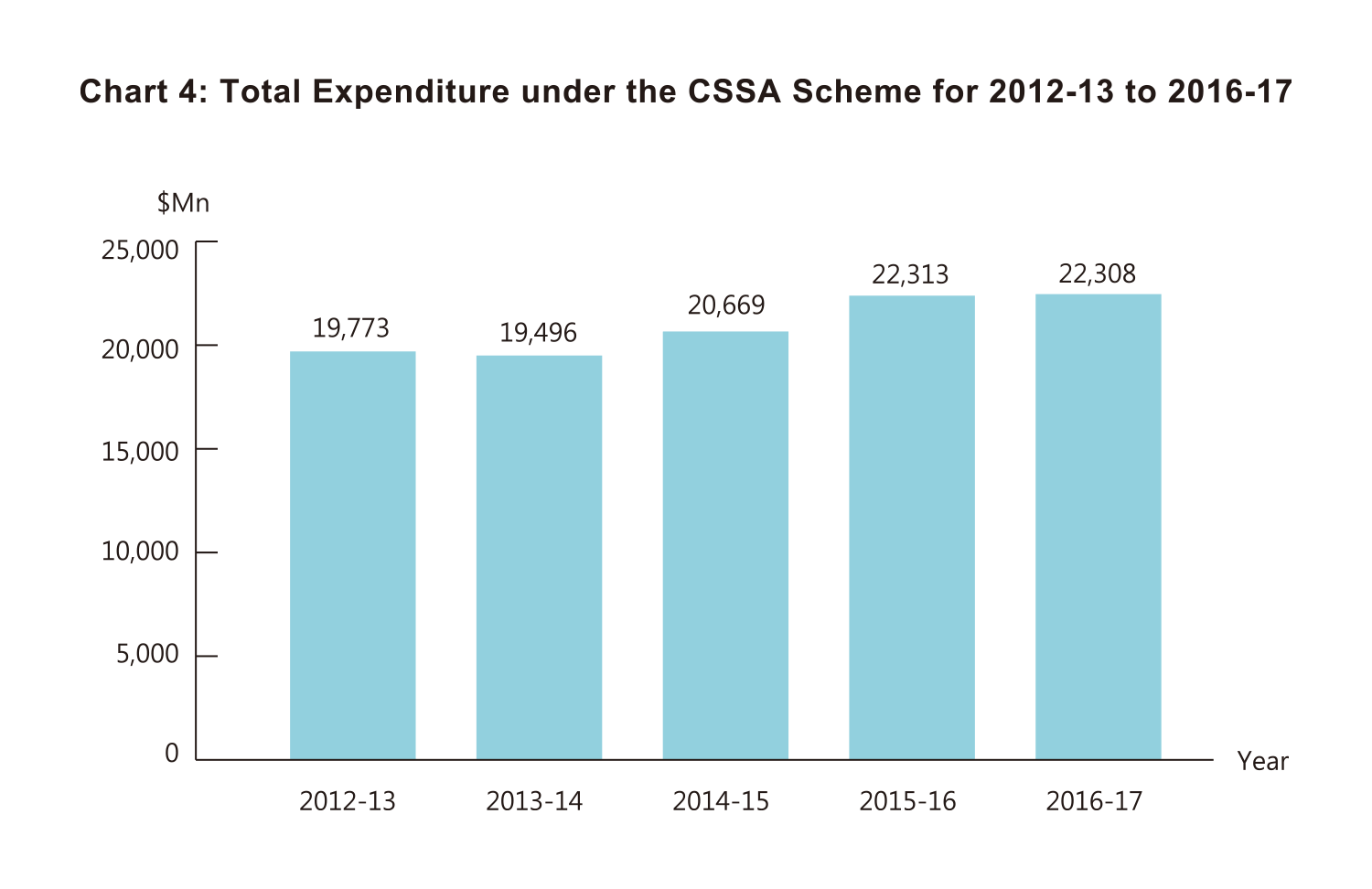

3.9

A total of $22,308 million was paid out under the CSSA Scheme in 2016-17. The total expenditure for the years 2012-13 to 2016-17 is shown in Chart 4 below:

SSA SCHEME

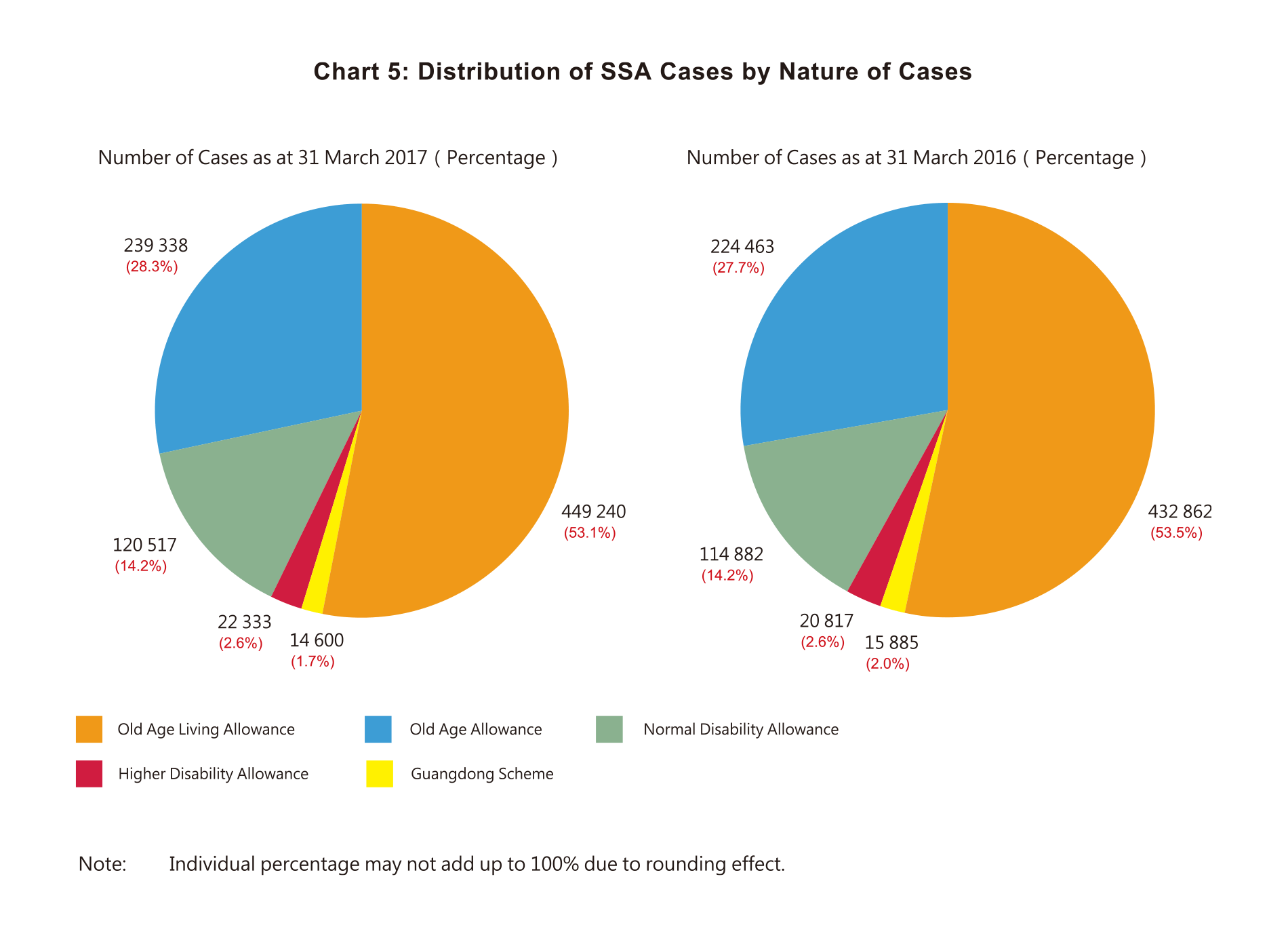

3.10

As at 31 March 2016 and 2017, the numbers of SSA cases were 808 909 and 846 028 respectively. A breakdown of these cases by nature of cases is shown in Chart 5 below:

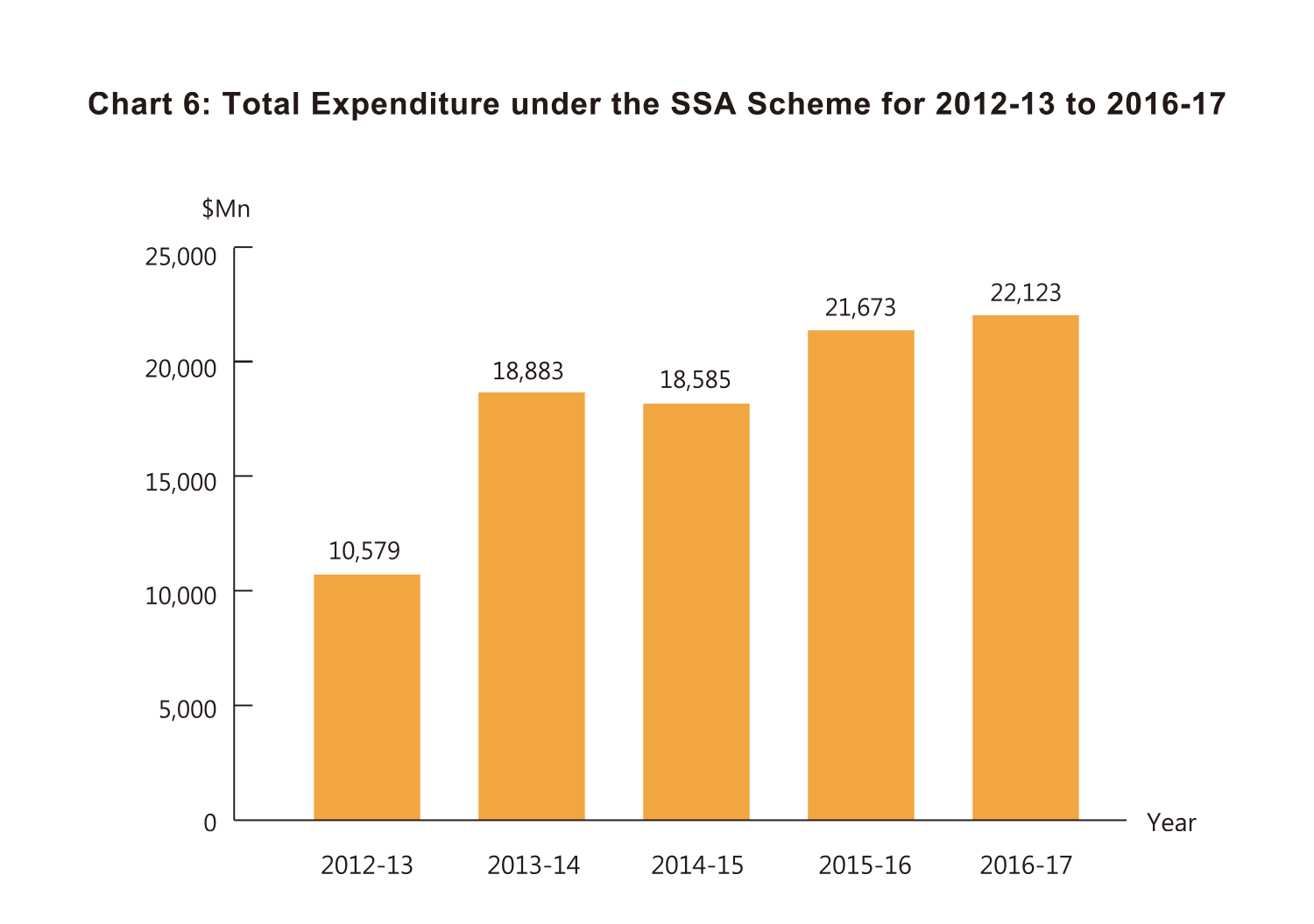

3.11

A total of $22,123 million was paid out under the SSA Scheme in 2016-17. The total expenditure for the years 2012-13 to 2016-17 is shown in Chart 6 below:

CLEIC SCHEME

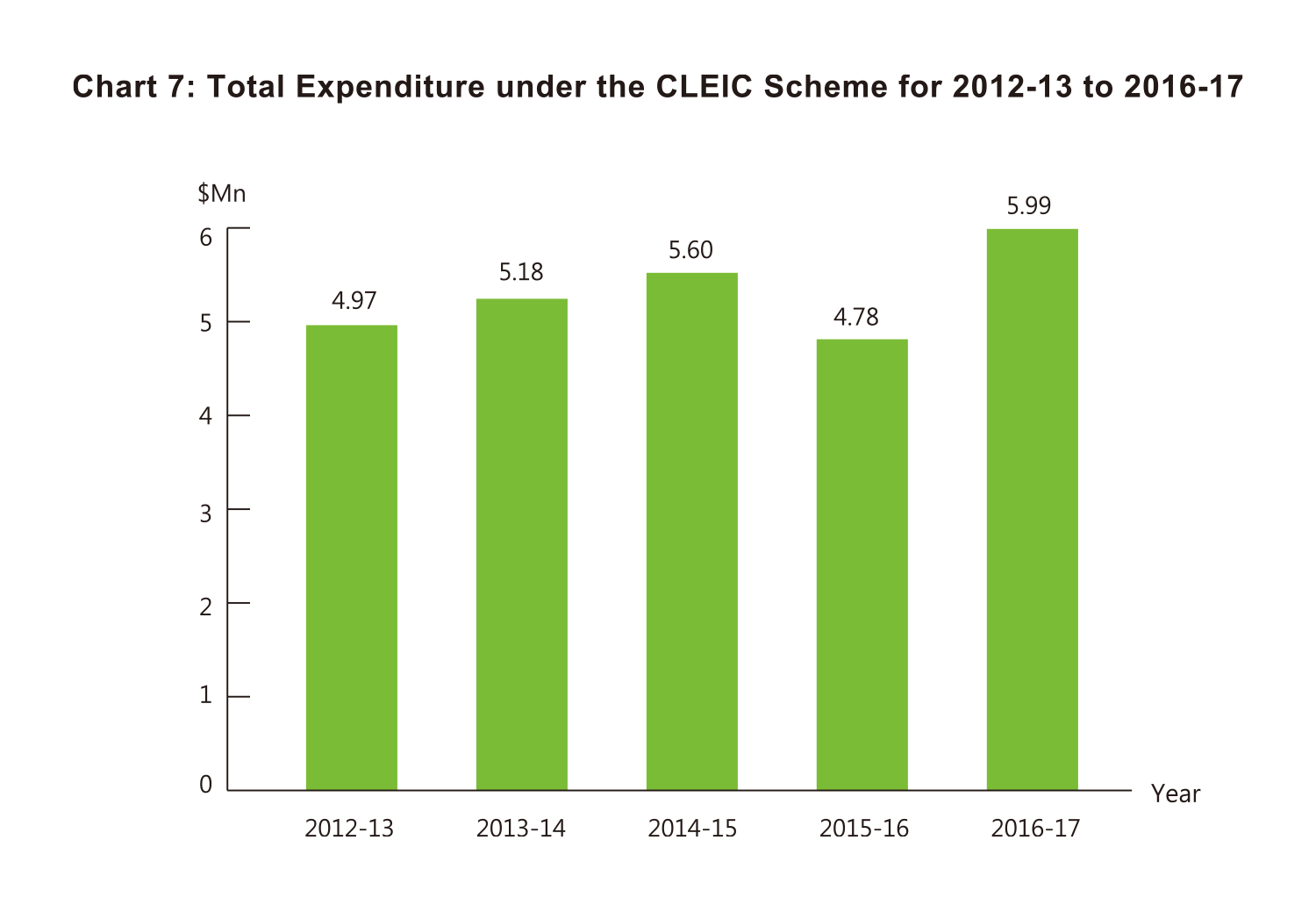

3.12

In 2016-17, a total of $5.99 million was paid out under the CLEIC Scheme to 299 cases. The total expenditure for the years 2012-13 to 2016-17 is shown in Chart 7 below:

TAVA SCHEME

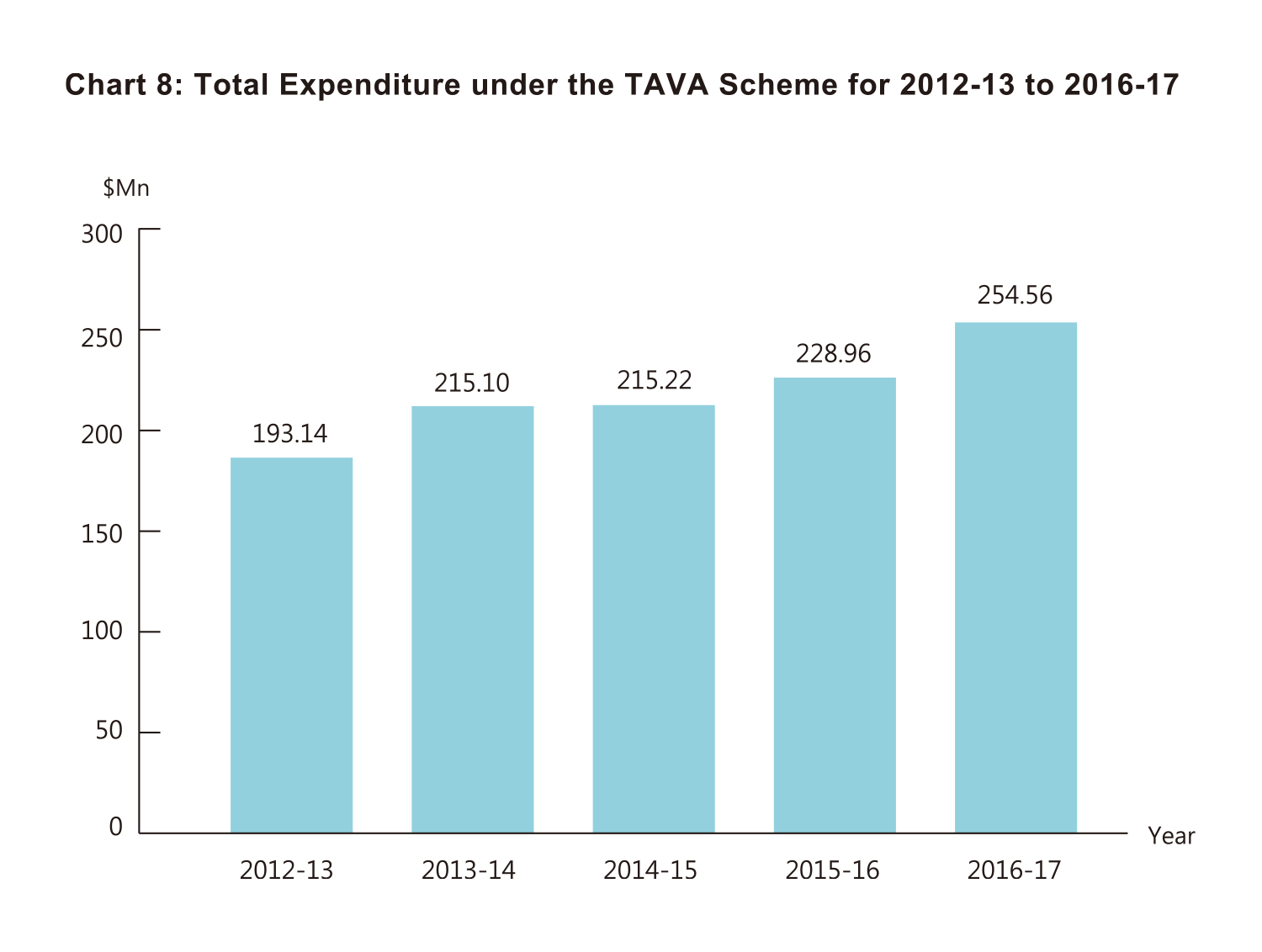

3.13

In 2016-17, a total of $254.56 million was paid out under the TAVA Scheme to 12 854 cases. The total expenditure for the years 2012-13 to 2016-17 is shown in Chart 8 below:

SOCIAL SECURITY APPEAL BOARD

3.14

The Social Security Appeal Board (SSAB) is an independent body comprising seven non-officials appointed by the Chief Executive. Its main function is to consider appeals against the decisions of the SWD under the CSSA, SSA and TAVA schemes. Decisions of the Board are final.

3.15

In 2016-17, the SSAB ruled on 392 appeals, including 76 CSSA cases, 315 SSA cases and 1 TAVA case. The Board confirmed the decisions of the SWD in 297 cases (76%) and varied its decisions in 95 cases (24%).